What does financial freedom mean for you? For many people, it means making their money work for them so they have resources available on hand when they need them. Whether you live alone or have a family, a money management plan ensures you stay on track financially and use your resources to their fullest.

A good money management plan gives you security and helps to make sure nothing slips through the cracks. It keeps you moving toward your financial goals, both big and small.

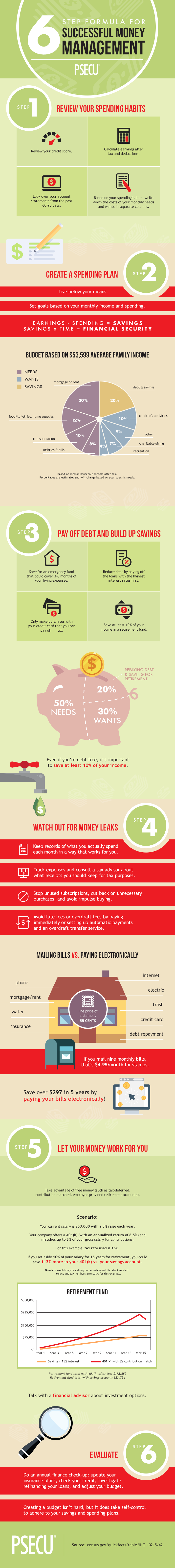

![]() This work is licensed under a Creative Commons Attribution-NoDerivs 3.0 United States License. If you like our infographic, feel free to share it on your site as long as you include a link back to this post to credit PSECU as the original creator of the graphic.

This work is licensed under a Creative Commons Attribution-NoDerivs 3.0 United States License. If you like our infographic, feel free to share it on your site as long as you include a link back to this post to credit PSECU as the original creator of the graphic.

Set Goals

The first step in developing your personal or family money management plan is determining what you want to achieve with your money. You may have multiple goals, such as to:

- Save for retirement

- Pay off your debt

- Buy a house

- Start investing

When setting your goals, consider your monthly income and spending. Also, consider where you’d like to be in five, ten or twenty years from now. What goals do you need to set to get there? Which financial goals are most important to you right now?

Improve Your Credit Score

Your credit score can help you get a job, buy a house and apply for a loan. It’s one of the most important factors that could help your individual or family finances. The good news is that you have control over your credit score, which is a number that reflects how well you’ve managed your money in the past.

You can’t build credit without getting a loan or credit card. For example, by taking out student loans and staying on top of your monthly payments, you can work toward building a strong credit history.

Paying off your loan and credit card debt on time is also important because it proves you are financially responsible and means the ratio of credit available to debt remains high. However, be careful when considering closing a credit card. Having some debt can actually be good for your credit score. For example, having a longstanding credit card open with no balance can improve your score.

Learn more about the five components of a credit score here.

Conduct an Annual Financial Check-Up

Successful money management requires reviewing your finances regularly. At least once a year, you will want to conduct basic maintenance, including:

- Reviewing your loans. Consider whether you need to refinance your mortgage and other loans. If your credit has improved or your situation allows you to pay off a loan more quickly, it may make sense to refinance to enjoy savings on interest.

- Adjusting your budget. Part of managing family finances means adapting to change. If you have no budget, now is the time to create one. If you have a budget, it’s time to review. Should you put more into investments or savings? Are you overspending in some areas?

- Checking your credit. Visit annualcreditreport.com for your free credit report from one of the three credit bureaus once a year. Check for any unusual activity and report any mistakes. Then, follow up to ensure any issues have been resolved. Checking your credit once a year can help you detect identity theft and protect your score.

- Updating your insurance plans. Do you have the coverage you need? Can you get a better deal on insurance by shopping around? Consider getting a quote and changing coverage to make sure your insurance reflects your current needs.

To learn more about how to manage your money, visit WalletWorks for financial tips, videos and other resources. Don’t forget to download our budget worksheet to get started on creating your own money management plan.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.