Being a parent is worth every penny of investment in your child. But how much, exactly, does that investment add up to? The answer may surprise you.

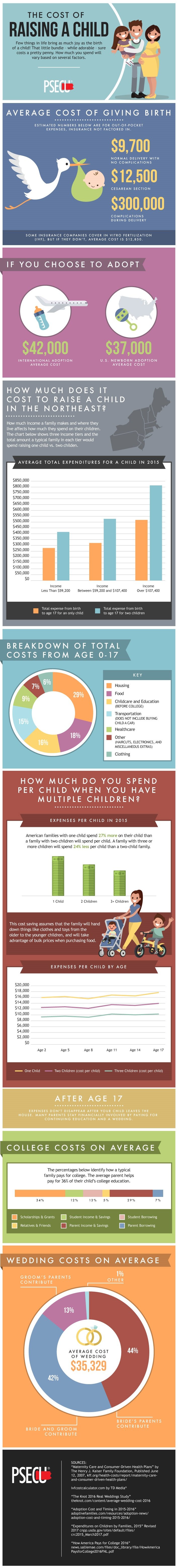

The total amount varies depending on where you live, how the child is delivered, whether you adopt, and a slew of other variables. But for virtually any family under any circumstances, it takes more than $260,000 to raise a single child from birth to age 17.

Does that sound high? When you take into account the things that go into caring for a child, such as healthcare, food, clothing, transportation, and more, perhaps it’s not actually that much.

We’ve put together an in-depth look at where your money goes when you have children. Remember, part of good financial management is keeping track of such things. Take a look at our infographic, which breaks down the costs and how it may vary based on your income level. Then read below to find out how expenses can vary by location and how much parents pay for childcare.

This work is licensed under a Creative Commons Attribution-NoDerivs 3.0 United States License. If you like our graphic, feel free to share it on your site as long as you include a link back to this post to credit PSECU as the original creator of the graphic.

How Much Does Raising a Child Cost in Different Parts of the Country?

You know about the basic costs of raising children, but those can vary depending on where you’re located and how old your child is.

As they get older, children tend to cost more. Living in the urban Northeast is the most costly area to raise a child. Having a 15- to 17-year-old child costs an average of more than $15,000 annually. By contrast, a child of the same age in a rural location will cost a bit over $10,000 per year. The urban West is the second-most expensive, at between $12,500 and $15,000 for a child of that age, followed closely by the urban South and urban Midwest.

Costs per child also vary depending upon how many children you have.

What’s the Most Expensive Form of Childcare?

In the past few years, the cost of childcare has risen. Below are the national averages for the weekly costs of the most common childcare types, according to Care.com®:

- Nanny: $565

- Au pair: $367

- After-school sitter for 15 hours per week: $232

- Daycare: $211

- Family childcare center: $200

Nannies remain by far the most expensive option. But even the cheapest form of childcare, the family childcare center, can cost a family with one child upward of $800 per month. For many of these childcare options, the cost of things your child will need throughout the day, such as diapers, wipes, and food, are not included and are an additional cost.

While it won’t come close to offsetting the cost of childcare, it’s worth looking into the possibility of paying for your daycare and related expenses with a cash rewards credit card, such as our Founder’s Card, which lets you earn rewards on each purchase. Just be sure you only use this option if you’re able to pay the balance off each month – otherwise, you may end up paying more in interest than you earn in rewards.

How Much Does Healthcare Cost for a Child?

Healthcare is another major expense. Though many families have health insurance plans for every family member, it’s difficult to determine exactly how much it costs for one child. An average employer-sponsored PPO, or preferred provider organization, costs $26,944 for a four-member family each year. Of that, $11,685 on average is paid by the family through out-of-pocket payments and payroll deductions.

Where Does the Money Go?

In the USDA’s “Expenditures on Children by Families” report, the cost of raising a child is broken down into seven categories. Here are the descriptions for each:

- Housing: Includes shelter, such as parent’s mortgage payment, property taxes, repairs, utilities, and home furnishings.

- Food: Includes food and non-alcoholic beverages.

- Transportation: Includes payments on a parent’s vehicle, maintenance, car insurance, public transportation, and airline fares.

- Clothing: Includes items such as children’s apparel, diapers, and footwear.

- Healthcare: Includes medical and dental services not covered by insurance, medicine, and health insurance premiums.

- Childcare and Education: Includes babysitting, daycare, school supplies, and high school tuition if they attend private school.

- Miscellaneous: Includes children’s personal care items, entertainment, and non-school-related reading materials.

Raising children isn’t cheap, but it’s an investment that’s definitely worth it. Find more money management tips on our WalletWorks page.

Learn About PSECU’s Money Back Banking

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.