What are some of your financial goals? You might want to buy a house, purchase a car, or pay off your student loans. Usually, working toward financial goals means establishing, building, or repairing your credit history.

Building credit is sometimes described as a Catch-22, or a complicated version of the “chicken and egg” question. To get credit, you typically need credit. An institution you’re working with for a loan will usually look at your credit report to see that you have a history of paying on time. Without an established history, your applications are more likely to be denied. If you are approved, the terms of the loan might not be so great.

Establishing and improving your credit history might seem challenging, but it’s not impossible. There are a few things you can do to get your credit history started and work toward a good credit score to help your chances of qualifying for the best terms on a mortgage, car loan, and other forms of credit in the future.

Why is Your Credit History Important?

Not having a sufficient credit history can stand in the way of you reaching your goals. Your credit history can affect your living situation and your cost of living.

Credit can play a large part when you’re applying for common loans:

-

When you’re applying for a car loan. When you finance the purchase of a car, the car dealership or lender may pull your credit report and credit score and may use one or both to determine what interest rate and other terms to offer you.

-

When you’re applying for a mortgage. A lender will also pull your credit report when you apply for a mortgage to purchase a home. Because mortgages tend to be large amounts of money, potential lenders want to make sure you can afford to take on the debt and have a history of making on-time payments, among other things.

Although you might assume your credit doesn’t matter if you aren’t planning on applying for a loan or refinancing an existing loan, your credit history has many far-reaching effects. If you don’t have a long history or if there’s history of you falling behind on bills in the past, it can affect your ability to get a job, an apartment, or a reasonable rate on insurance.

-

When you’re trying to rent an apartment. A credit check is a standard part of the application process when you are apartment-hunting. Most landlords will run your credit and might deny or accept your application based on what they find. If you’re approved with a lower credit score or limited credit history, you may be required to pay a larger security deposit.

-

When you’re setting up a utility service. If you’re setting up utility services, such as electricity, for the first time or are moving to a new area and switching providers, the company might check your credit. Your credit history can influence whether or not the utility company asks you to pay an additional deposit at the start of your service.

-

When you want to refinance a loan. If you took out a loan, such as a mortgage or a student loan, when interest rates were high, it might make financial sense to refinance when rates are lower. Part of the refinancing process is having a lender check your credit. Your credit history and score will help to determine your interest rate, and then you can make a decision about whether or not refinancing will help you save money.

-

When you’re purchasing insurance. When you’re shopping for insurance quotes, a broker or insurance agency is likely to check your credit. Your credit history and score influence the premium an insurance company will quote to you. When insurance companies check your credit, it’s typically a soft inquiry, meaning the credit check won’t affect your score.

-

When you’re applying for a job. Some employers ask to run a credit check as part of the job application process. An employer won’t see your credit score when they run your credit. Instead, they’ll see a history of your payments and debts. An employer credit check is a soft inquiry and won’t affect your score. Many employers check your credit even if you’re not going to be handling financial matters.

Ways to Build Up Your Credit History

If your credit history is thin or isn’t what you want it to be, there’s hope for you. Building up credit

1. Monitor Your Credit

Before you can make changes to your credit history, it helps to know where you stand and what your credit score is. It also helps to understand what credit scores mean.

When evaluating your credit based solely on your credit score, a lender is likely to use one of two scoring systems, FICO® or Vantage. As of 2023, both FICO® and Vantage scores range from 300 to 850. The higher the score, the better your credit. The score ranges for FICO® Scores are as follows:

-

Poor: 300 to 579. If your score is under 579, there’s a chance that your application for credit will be turned down. You might have to pay a deposit or accept a loan with a high interest rate.

-

Fair: 580 to 669. If your score is between 580 and 669, a lender might give you a loan but will consider you a subprime borrower, meaning you’re likely to see a higher interest rate and more fees than someone with higher credit.

-

Good: 670 to 739. You paid your bills on time, and that’s helped get you into the “good’ range. As a result, a lender might offer you a better interest rate.

-

Very good: 740 to 799. With a very good credit score, you’ll see better interest rates and loan terms than people with lower scores.

-

Excellent: 800-850. If your score is over 800, you’re going to get the best rates and terms possible on a loan.

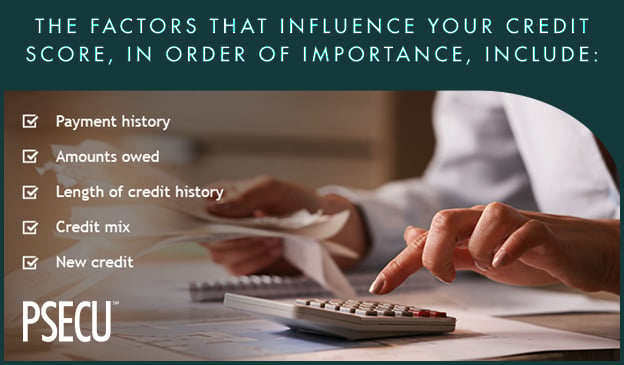

Knowing your credit score is just the first part of rebuilding credit. It’s also vital that you understand what affects your credit score and what you can do to improve it. FICO uses several data categories to calculate your score. Some categories have a more significant effect on your overall score than others. The factors that influence your credit score, in order of importance, include:

-

Payment history. Payment history makes up more than one-third of your FICO . The single most important thing you can do to build your credit is to pay your bills on time.

-

Amounts owed. How much you owe in comparison to the amount of credit available to you also makes up a significant part of your score. If you have a $10,000 credit limit and you currently owe $9,000 on your credit cards, a lender might be cautious about giving you another loan, as you might be financially over-extended.

-

Length of credit history. How long you’ve had credit also impacts your score. As long as you keep paying your bills on time and maintain a low utilization ratio, you’re likely to have a better credit score the longer you’ve had credit established.

-

Credit mix. The variety of credit you have, such as credit cards, a mortgage, and student loans, affects your score somewhat.

-

New credit. The number of recently opened accounts also affects your score. If you go shopping and open several store credit cards on the same day, you’re likely to see at least a slight drop in your score. Because creditworthiness is based on history, if you have several new accounts, there’s no way for lenders to determine yet if you’re able to handle the burden.

Now, free credit score monitoring is a relatively common service offered by financial institutions. Keeping an eye on your credit score helps you see how you’re doing when it comes to building your credit. It can also alert you to any negative changes in your history or to any reporting errors that can make your score lower than it should be. It’s important to not just check your credit score, but your credit report, as well, since all of the information in your report is used to calculate the score. If you find inaccurate information and need to dispute an error on your credit report, contact both the credit reporting company and the company that provided the information.

2. Pay Card Balances in Full and on Time

Your payment history makes up over a third of your credit score and, therefore, is a significant part of your credit history. As you build credit, making payments on time is one of the most important things you can do to improve your score.

When you’re focusing on building credit, it’s a good idea to look beyond paying on time. Because the amount you owe is another 30% of your credit score, it’s also essential to keep your credit balances low, especially for credit cards.

When you use a credit card, you have the option of paying the balance in full before the due date or making a partial payment. The minimum payment on a credit card balance is usually a small percentage of the balance due. Paying the minimum due can seem helpful if you’re struggling to pay your bills, but it does make using your credit card more expensive since interest will accrue on the unpaid portion. This means that not only are you carrying more debt and impacting the amount owed in your credit score, but also spending more money in the long run on the same items.

Credit card issuers are required by federal law to include a chart on your credit card statement that breaks down how long it will take you to pay off the balance if you pay just the minimum payment. The chart also tells you how much you’ll end up paying in interest over the payment period.

Along with helping you to pay less in interest, there are other reasons why paying your balances in full is a good move. A common credit card myth

The total amount you owe is the second biggest factor that determines your credit score. If you have a $10,000 credit limit and you owe $8,000 on your credit card, your credit utilization ratio is 80%, as you’re using eight-tenths of the credit you have available. To get the best score possible, it’s recommended that you keep your credit utilization ratio below 30%. If you have a $10,000 credit limit, that means your balance should be less than $3,000.

In addition to helping your credit score, keeping your balances low also helps to reduce the risk of you maxing out your credit cards. Emergencies can happen, such as a surprise hospital visit or pricey car repairs. While, ideally, you’d be able to pay for these expenses out of an emergency savings fund, there are times you may need to charge these unexpected expenses and having credit available will allow you to do so.

If you have trouble remembering due dates, there are a few tools that can help you remember to make your payments on time. For instance, PSECU’s free bill payer service allows you to automate payments or set reminders when you have a bill coming due. Automating your credit card payments means you don’t have to remember to pay your bills on your own. If you want to double-check that you have the funds in your account before your payments get sent, another option is to set up payment reminders before the due date.

It’s also a good idea to read over your statements monthly to confirm that the company received your payments. Reviewing your statements allows you to catch any mistakes, such as a charge for something you didn’t buy or a duplicate charge.

3. Choose a Debt Repayment Strategy

If you currently have a substantial amount of debt, reducing it can help to improve your credit. Reducing your debt can also help you save money in the long run. Depending on how much you owe and over how many accounts, you might not be sure which debts to pay down first.

How you tackle your debt repayment is based on your specific situation. Two common methods are the debt avalanche and debt snowball methods

The debt avalanche method has you focus on paying off the loan with the highest interest rate first – just like how an avalanche starts at the peak and tumbles downward. This allows you to save the most on interest in the long run.

The debt snowball method has you focus on paying down your smallest debts first and then working to eliminate larger ones – just as a snowball starts small and gets bigger and bigger. While you won’t save as much in interest payments, the quick wins of eliminating payments can help you stay motivated to continue.

If you’re concerned about a high balance on one account, you might focus on that debt first, even if it isn’t your smallest loan or your most expensive debt.

4. Don’t Apply for Too Much Credit at Once

As you go about establishing or building your credit history, you may assume that the more credit accounts you have, the better.

While it’s true that opening more accounts will increase your available credit and lower your credit utilization ratio (as long as you don’t run up charges on all of your accounts), opening many accounts simultaneously can be a red flag to lenders. It can send the message that you need cash or financial assistance, which can make you seem like more of a risk. It can also make lenders wary because the accounts haven’t been open long enough to determine if you have the financial bandwidth to handle the payments on them. If you open several credit card accounts or loans close together, your score is likely to drop.

There is one exception to the rule, and that’s if you’re shopping around for the best rate on a loan. When you’re looking for a car loan or a mortgage, it’s common to apply at several different places. This is called rate shopping.

For example, having a lender pull your credit to apply for a mortgage will drop your score somewhat. But if you have several lenders pull your report during a two-week period, you won’t be penalized for each subsequent inquiry. The assumption is that you’re investigating your options and that you don’t plan on getting multiple mortgages or car loans.

5. Consider Possible Impacts Before Closing Accounts

You might have an old card you never use anymore. It might be your first credit card or a card for a store you shopped at a lot when you were younger but hardly ever purchase from anymore. As you’re looking to improve your credit, you may wonder if it’s time to close accounts you don’t use.

The answer is that it depends and that you should consider possible impacts before closing an account. Closing an old account can impact your credit utilization ratio, especially if you’re carrying high balances on other cards.

However, it doesn’t always make sense to keep an old account open – for instance, if you have an old credit card that’s charging you an annual fee, it might be time to say goodbye.

Before you close an account, you should consider the impact to your credit score, as well as to your wallet. If you’re in the process of applying for a large loan, like a mortgage, you may want to talk to your potential lender to ensure that closing an old account, and the impact it could have on your credit, won’t hurt your ability to be approved for the loan.

6. Create a Budget and Stick to It

Having a budget can help as you build credit for the first time or attempt to rebuild it. When you have a budget, you know exactly what you earn and how much you can spend. Knowing your numbers can help you avoid purchasing things you can’t afford. Your budget can also guide you toward your goals.

Along with sticking to a budget, it can be a good idea to create credit rules for yourself. Decide what purchases you’ll make with your card and use either a debit card or cash for everything else. For example, you might decide that you’ll buy groceries with your credit card or use your credit cards to pay your utility bills. Having clearly defined rules for your cards will help you avoid the temptation to charge things you don’t need or don’t have room for in your budget.

7. Seek Out Credit-Building Tools

As you work to build your credit

Some credit-building options include:

-

Getting a secured credit card. While many credit cards are unsecured and have no collateral, when you open a secured card, you put a deposit down first. The deposit acts as collateral on the card. You still have an obligation to make your secured credit card payments on time, which will help build your credit. If you default on your payment, the lender can repay the obligation directly from the collateral. Be aware that your default may result in your lender closing your secured credit account and may place negative information on your credit report. We offer a Secured Visa® card as a responsible and easy way to build good credit. It has no annual fee, competitive rates, and a sliding scale for collateralization.

-

Using a cosigner. A lender might turn you down for a loan if you apply on your own, but they may approve your application if you can find someone to cosign with you. A cosigner is usually someone with an established credit history and significant income who’s willing to accept responsibility for the loan with you. If you or the cosigner fall behind on payments, you’re both held responsible for the loan.

-

Becoming an authorized user. If someone else, such as a parent or spouse, already has a good credit history and a credit card account, they might be willing to add you as an authorized user on their account. As an authorized user, you can use the credit card to make purchases. The card appears on your credit report, helping you to establish a history. One drawback of being an authorized user on someone else’s account is that if they fall behind on payments, your credit can suffer, too.

PSECU Offers Credit Cards for All Stages of Life

As long as you pay the balance in full each month and don’t charge more than you can afford to pay off, a credit card can be an excellent tool for building credit. Learn about the variety of credit cards PSECU offers, including a Secured Visa® card, a Classic Card, and our Founder’s Rewards Card, which offers cash rewards.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.