Hiring and retaining top talent is important to a company’s success. While offering employees competitive salaries is one way to attract candidates, it’s also a good idea to provide appealing benefits.

The right benefits can be desirable enough that a candidate might consider accepting a lower salary. With that in mind, what benefits are the most popular?

What Are the Most Popular Benefits?

Job benefits are a kind of compensation a business gives to employees in addition to their wages. Some companies offer a variety of benefits, while others provide just one or two. Offering the right mix of benefits can be what makes or breaks a job offer.

Here are some of the most attractive benefits for potential hires.

Health Insurance

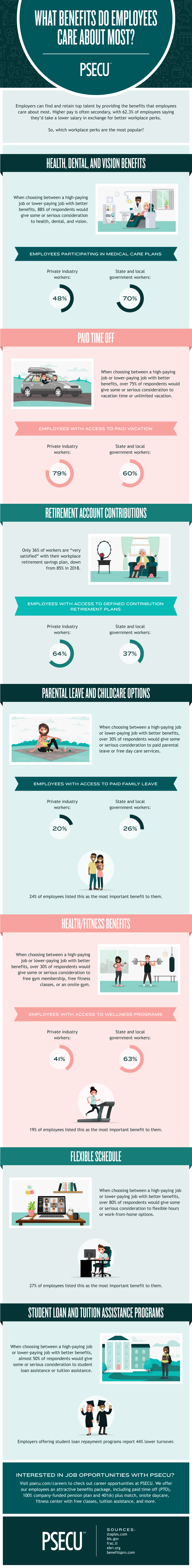

Health benefits, including medical, dental, and vision insurance coverage, are perhaps the most popular type of job benefits. In 2020, 48% of private industry workers and 70% of government workers had a medical care plan through their employer.

Health insurance is so important to employees that many would consider taking a job with a lower salary but excellent health coverage over a position with a higher salary and less insurance.

Paid Time Off

Everyone needs a break from time to time, which might be why paid time off is another popular perk. Between 60% and 79% of workers had access to paid vacation days in 2020. Like health insurance, many job candidates seriously weigh the pros and cons of taking a job with ample paid time off and a lower salary versus a job with a higher salary and fewer vacation days.

Vacation isn’t the only reason why an employee might want to have paid time off, either. Workers also may need to take days off when they’re sick or if they have personal commitments to attend to. Having more paid time off can be the deciding factor on whether or not someone accepts a job offer.

Retirement Savings

Many employees aren’t only focused on earning money for the present. They’re also concerned about having enough money in retirement.

Retirement savings options might be one area where employers can afford to pick up the slack. In 2020, just 36% of workers stated they were “very satisfied” with their employer-sponsored retirement savings plan.

Employees who have access to retirement savings plans through their employer typically have a defined contribution plan, meaning they contribute to the retirement account from their earnings. Their employer might match contributions as well. An employer match is often a popular perk, as it gives the employee extra money for their retirement.

Parental Leave and Childcare

In the U.S., the number of dual-income households with kids under 18 has been increasing since the 1960s. That means many of today’s workers are likely to need time to take care of their kids or time off to give birth to or adopt children.

Parents are also likely to need someone to care for their children while they’re at work. Employers that offer some form of paid parental leave and offer child care perks or assistance are often more attractive to workers than employers that pay high salaries but offer little in the way of child care or parental assistance.

Wellness Perks

Wellness perks, like free gym memberships or an onsite gym, aren’t as in-demand as other employee benefits, like health insurance, retirement options, or parental leave. But for some candidates, wellness benefits are a must-have.

Examples of wellness perks can include gym access, free fitness classes during lunch breaks, or nutrition counselors.

Flexible Scheduling

While the traditional 9-to-5 schedule might work for some employees, it isn’t always ideal. Employees might have various reasons for wanting a more flexible schedule from their employers, from caring for children or aging parents to having medical concerns of their own. Some workers also find that they’re most productive at unconventional times.

When it comes to flexible scheduling, nearly three out of 10 employees consider it the most crucial job perk.

Tuition and Student Loan Assistance Programs

A reliable way to keep the best employees on the payroll is to offer student loan repayment assistance. That makes sense, considering 54% of people who went to college took on some student loan debt to pay for it.

For people who want to continue their education, tuition assistance is another popular perk. Tuition assistance often means that an employer will cover the cost of enrolling in a program, provided the education a person receives is relevant to their current career.

Interested in Job Opportunities with PSECU?

Want a job with excellent benefits? Check out the career opportunities at PSECU. Head to psecu.com/careers to see our open positions. Our benefits packages include paid time off (PTO), 100% company-funded pension plan and 401(k) plus match, onsite daycare, fitness center with complimentary classes, tuition assistance, and more.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.