Do you need an easy and visual way to keep track of your life? Perhaps you have a hard time sticking to a budget or saving money?

If you’re a college student, you may want to consider bullet journaling to help you stay organized. Even if you’re not a student, you can still employ these bullet journal ideas to organize your personal finances.

What Is Bullet Journaling?

A bullet journal is a combination of journaling and to-do lists. While bullet journaling began as simple bulleted lists using a method called rapid logging, it has morphed slightly to allow creativity and design to play important roles in how you’ll organize your entries. To start, you’ll need a few items.

- Colored pens or markers

- Dotted page notebook

There are no hard-and-fast rules to bullet journaling. How you do it largely depends on your personal preferences for organization and the amount of time you want to devote to your journal.

Here are a few things you can include in your bullet journal to get started.

- Index: An alphabetical list that reminds you where to find the things you’ve written about and how you’re tracking progress. You can update it as you write.

- Future Log: A 12-month calendar where you can track goals, deadlines, and aspirations.

- Daily Log: A list of to-dos and accomplishments that show what you’ve finished and what you still need to work on each day.

- Monthly Log: The place where you track what you want to tie up this month, as well as carry over things you didn’t finish from last month.

Personal Finance Bullet Journal Ideas for Students

In addition to keeping track of your to-dos, bullet journaling can be an excellent method to help you manage your budget and reach financial goals. By recording your progress in your bullet journal, you’ll stay on top of your expenditures and see where your money is really going, allowing you to find ways to cut spending and save money.

Make a Monthly and Annual Budget

Even if your parents handle many of your expenses, you can still record what you spend on things like nights out, school supplies, and apparel.

Even if your parents handle many of your expenses, you can still record what you spend on things like nights out, school supplies, and apparel.

If you need help coming up with categories to track, you can use our free budget worksheet as a guide.

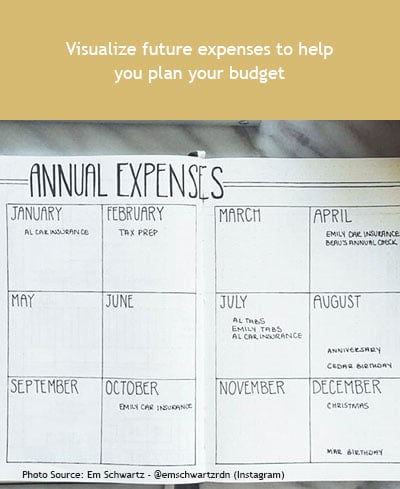

Your monthly budget may not account for larger one-time purchases. To help remind you to save money for these items, you can create a bird’s-eye view of any big annual expenditures. This could include your spring break road trip, birthday and holiday gifts, or a trip abroad.

Separate Needs From Wants

Looking at our successful money management infographic, you’ll see that many budgets are split into three areas.

- 50% Needs

- 30% Wants

- 20% Repaying Debt and Savings

You can curb your tendency to overspend by creating a bullet journal page listing out items that are “needs” and ones that are “wants.” Ignoring the “wants” may help you rein in your bad shopping habits.

You can curb your tendency to overspend by creating a bullet journal page listing out items that are “needs” and ones that are “wants.” Ignoring the “wants” may help you rein in your bad shopping habits.

If you’re not sure how much you spend at the end of each month, take time to write down what you spent in red ink at the end of each day. You may find after a week that your daily coffee habit is costing you $45, which adds up to nearly $200 per month. Once you realize this, you can easily cut back to save money.

Manage Your Off-Campus Bills

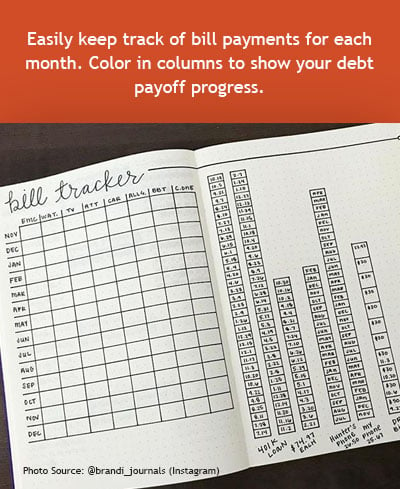

Moving off campus gives you freedom, but it also requires responsibility. Living in an apartment means you’ll need to pay rent and utility bills, and it’s important that you pay them on time. Using a bullet journal can help you keep track of what you’ve paid and when.

Moving off campus gives you freedom, but it also requires responsibility. Living in an apartment means you’ll need to pay rent and utility bills, and it’s important that you pay them on time. Using a bullet journal can help you keep track of what you’ve paid and when.

To help track your bills, create a table in your bullet journal like the one above so you can easily mark which ones have been paid for that month. You can also track debts you need to pay off. As you pay down each debt, you can color in the column, which not only makes it easy to track but is also very rewarding to see.

Challenge Yourself to Save

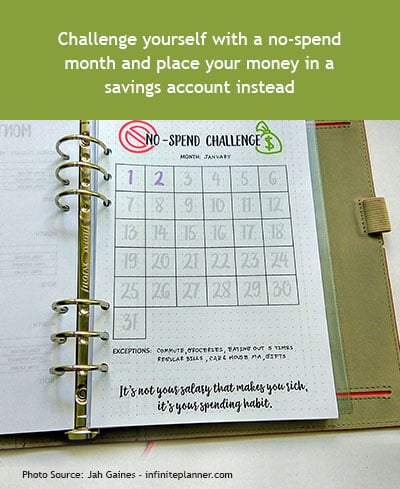

Creating a secure financial future starts with saving money. If you need motivation, consider adding a No-Spend Challenge to your bullet journal where you color in each day that you didn’t spend any money unnecessarily. To keep yourself on track, make a list of what your necessary purchases include, such as transportation and groceries.

Creating a secure financial future starts with saving money. If you need motivation, consider adding a No-Spend Challenge to your bullet journal where you color in each day that you didn’t spend any money unnecessarily. To keep yourself on track, make a list of what your necessary purchases include, such as transportation and groceries.

You also may find it helpful to add a page to your journal where you can track bigger savings goals over a longer period of time, such as an emergency fund, retirement, vacation, or car fund.

Write Down Financial Goals

Writing down your goals holds you accountable to them, especially if you’re checking in on your progress often. You can use your bullet journal to chart progress you’re making toward your goal. Seeing your progress may help you continue to save even more.

Writing down your goals holds you accountable to them, especially if you’re checking in on your progress often. You can use your bullet journal to chart progress you’re making toward your goal. Seeing your progress may help you continue to save even more.

Your bullet journal savings page used in conjunction with the PSECU Savings app makes it even easier to make sure your money goes into a savings account so you don’t accidentally spend it.

Using these personal finance ideas for bullet journaling can help you get organized and keep more of your hard-earned money where it belongs – with you. Check out our WalletWorks page for more money management tips.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.