Your business may already offer programs to promote your employees’ physical and mental well-being, and those efforts may be paying off in the form of healthier and happier team members. But have you considered the benefits of offering a financial wellness workshop?

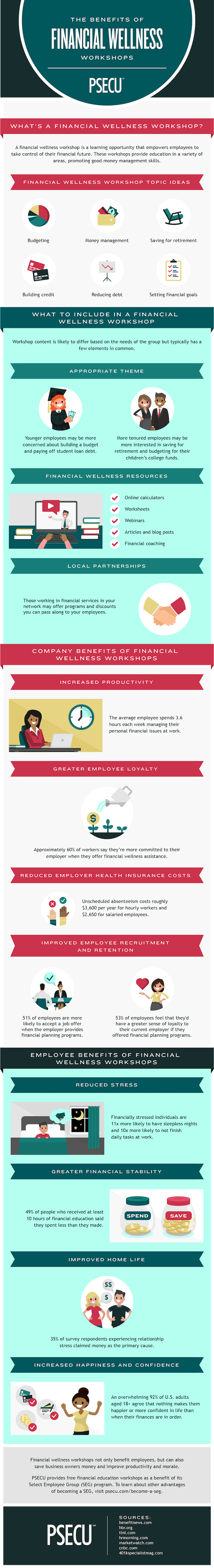

Financial wellness workshops can help your employees gain control over their financial situations. The topics of the programs can vary based on the needs of your team. A workshop can cover the advantages of saving for retirement and introduce employees to the different retirement account options available at your company. Another workshop can cover the ins and outs of budgeting, including how to create a budget and why smart money management is important. Other possible workshop topics include:

- Getting out of debt

- Setting financial goals

- Improving credit

Although financial wellness workshops can help your employees, the advantages don’t stop there. They can help your business, as well.

How to Plan a Financial Wellness Workshop

When planning a financial wellness workshop, it’s important to pair the content of the workshop with the target audience. Be sure to communicate the topics in advance so that employees know what to expect and if it would be beneficial for them to attend.

Choose a Theme

The theme of the workshop should be applicable to its audience. For example, a workshop that focuses on ways to pay off student loans will most likely be of interest to entry-level employees, while a workshop on catching up on retirement savings will likely appeal to employees who are closer to retirement age.

Although you can recommend a workshop to a particular audience, you don’t want to restrict access to it. A younger employee might find something of value in a retirement program, while a more tenured employee might learn something about student loans that they can share with their children.

Locate Resources

As you plan the workshop, look for as many resources as possible, both to help with the planning and to provide employees with useful tools.

For example, financial calculators can give your employees an idea of where they stand financially. Engaging articles and blog posts can explain complex financial topics in a fun and interesting way.

You might also consider bringing in a financial coach to lead the workshop and to offer their services to your team afterward. The coach can work with employees one-on-one to map out a plan for their financial success.

Find a Partner

Look for a local partner to sponsor the program, lead it, or offer a discount on services to employees who attend the workshop. For instance, an insurance company can lead a workshop on the benefits of being properly insured, or the company that sponsors your business’ retirement plan can hold a workshop on choosing a portfolio and the importance of saving.

For instance, if your company is a Select Employee Group (SEG) of a credit union, have a representative provide an overview of the products and services they offer and how they can benefit your employees. Or, if your employees could benefit from more information about their retirement options, have a representative from that company hold a workshop on choosing a portfolio and the importance of saving.

Benefits of Financial Wellness for Employees

Your employees can benefit from financial wellness workshops in multiple ways. When they have the tools and tips they need to put their financial lives in order, they’re likely to feel happier and less stressed. That can lead to them getting a better night’s sleep and to them enjoying a more peaceful home and family life.

Benefits of Financial Wellness for Employers

Financial wellness workshops also deliver benefits to the companies that offer them. When your employees are happy, they’re more likely to be loyal to your company, which can lead to higher retention rates. Including financial wellness as an employee benefit can also make your company a more attractive place to work, meaning you’ll have greater access to the best talent.

When your employees feel that they have their finances in order, they’re less likely to stress about money at work, which can lead to increased productivity. They’re also more likely to come into work as scheduled. Research has shown that employees with the highest levels of debt are twice as likely to miss work compared to those with the lowest levels of debt.

Members of PSECU’s Select Employee Group (SEG) program can take advantage of free financial wellness workshops, as well as financial resources and on-site visits. Learn more about becoming a SEG today.

The content provided in this publication is for informational purposes only. Nothing stated is to be construed as financial or legal advice. Some products not offered by PSECU. PSECU does not endorse any third parties, including, but not limited to, referenced individuals, companies, organizations, products, blogs, or websites. PSECU does not warrant any advice provided by third parties. PSECU does not guarantee the accuracy or completeness of the information provided by third parties. PSECU recommends that you seek the advice of a qualified financial, tax, legal, or other professional if you have questions.